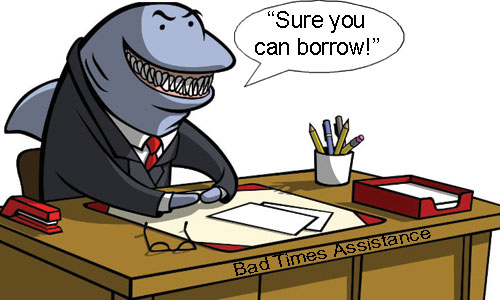

Inflation is a key economic indicator that affects the purchasing power of consumers in various regions, and Sudbury, Ontario, is no exception. As the cost of living continues to rise, many Sudbury residents are facing financial challenges. In recent years, one trend that has emerged is the increased popularity of online payday loan lenders. These lenders offer quick access to cash but often come with high fees and interest rates, making them a risky choice for borrowers.

Inflation is a key economic indicator that affects the purchasing power of consumers in various regions, and Sudbury, Ontario, is no exception. As the cost of living continues to rise, many Sudbury residents are facing financial challenges. In recent years, one trend that has emerged is the increased popularity of online payday loan lenders. These lenders offer quick access to cash but often come with high fees and interest rates, making them a risky choice for borrowers.

The rise of online payday loan lenders in Sudbury can be attributed to several factors, including the convenience of online borrowing and the economic pressures caused by inflation.…

You will always be individuals that grumble about their lifestyle. I’m not doing well as the economy is terrible. This’s incorrect, and that’s wrong, but hold on a second. Exactly why do you whine when you could take action to make things better?

You will always be individuals that grumble about their lifestyle. I’m not doing well as the economy is terrible. This’s incorrect, and that’s wrong, but hold on a second. Exactly why do you whine when you could take action to make things better?