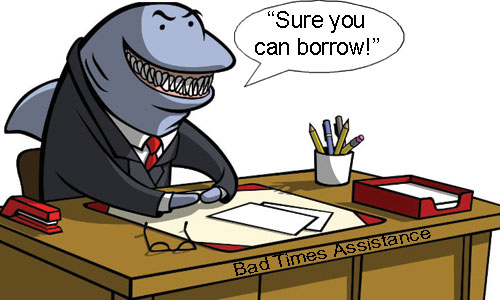

By Payday Loans Co. – BC, Canada – Laws are designed to protect individuals against “Loan Shark” practices where short term loans are given away at unnecessary interest rates. There’s an industry which has come of age the final few years which has circumvented these laws. Go into the Payday loan business.

By Payday Loans Co. – BC, Canada – Laws are designed to protect individuals against “Loan Shark” practices where short term loans are given away at unnecessary interest rates. There’s an industry which has come of age the final few years which has circumvented these laws. Go into the Payday loan business.

Payday loans is a some what brand new multi billion dollar business where individuals borrow money to tithe them through until the following payday of theirs. These loans likewise go by the names money advance loans as well as paycheck loans. They victimize the lower class which find themselves short of cash and seeking out companies such as Payday Loans Co. – Alberta, Canada

The thing to think about when looking right into a payday loan would be the APR or maybe Annual Percentage Rate which these loans carry. At first glance, you might feel having to pay $240.00 for a mortgage of $200.00 for 2 weeks is okay. The A.P.R of this particular loan visits a whopping 520 %. That’s the total amount this particular loan will cost you in case played over a years time period. Compare this with an impressive interest charge card of twenty nine %. If you notice it when compared with these numbers, you are able to see they’re not the great you initially thought it had been.

A representative from the Payday Loans Co. – Ontario, Canada company has agreed being interviewed for this information on the state the identity of his which of the company of his be anonymous. I asked him, just how can they are able to justify such enormous interest costs. The reply of his was “Because we are able to. Right now there are loopholes available that allow us to accomplish this. This’s a high risk loan for many cases so we have to charge sufficient to cover bad loans and then to make a profit.”

When asked about if payday loans are actually a great idea, the reply of his was “Sure. For instance in case you are going to be late on a charge card transaction of $70.00 and is charged a late charge of $30.00 then the APR of the payday loan justifies receiving one. You are going to save points in case you receive a payday loan and never pay the higher interest rate of the late fee.”

You will find occasions when payday loans are justified as mentioned previously. The main example when the late fees of yours are costlier compared to the late fees paid to the creditors of yours. One more non tangible justification happens when you are able to stay away from getting claimed for the late payment. This may be much more costly compared to any payday loan charge in that it might affect the price you spend on later loans. This’s particularly true if it is your car or mortgage payments.

One more motive to obtain a payday loan is you decide the price is worthwhile for you individually. In case you’re headed for the very long awaited vacation and would use a couple of extra bucks to experience and are able to afford the fees then you definitely need to consider this. A last thought on if you must buy a payday loan is in case you require the money and it is free. That is right no cost. You will find a numerous websites out there that control ZERO interest to all first time customers. One particular site could be discovered at Affordable Payday Loans.

The very first thing to search for is the APR. Federal law makes it so that each lender should disclose the price of any cash borrow by way of a fact in Lending Disclosure. This have to fail the price by APR (Annual Percentage Rate). This’s the very first thing to evaluate loans by.

Another point to search for would be the length of the word. In case 2 firms cost exactly the same price for every 100 bucks borrowed but organization A has a phrase of up to 4 days as well as company B has a term of 2 days, then aim for Company A and get advantage of additional 4 weeks. The APR of Company A is one half of Company B. The main reason this varies from the very first product is the fact that often they base APR on a fixed quantity of time (two three weeks usually). Once you read through the small print which the fee charge is fixed and could enable you to pay it also in a longer term including 4 days.